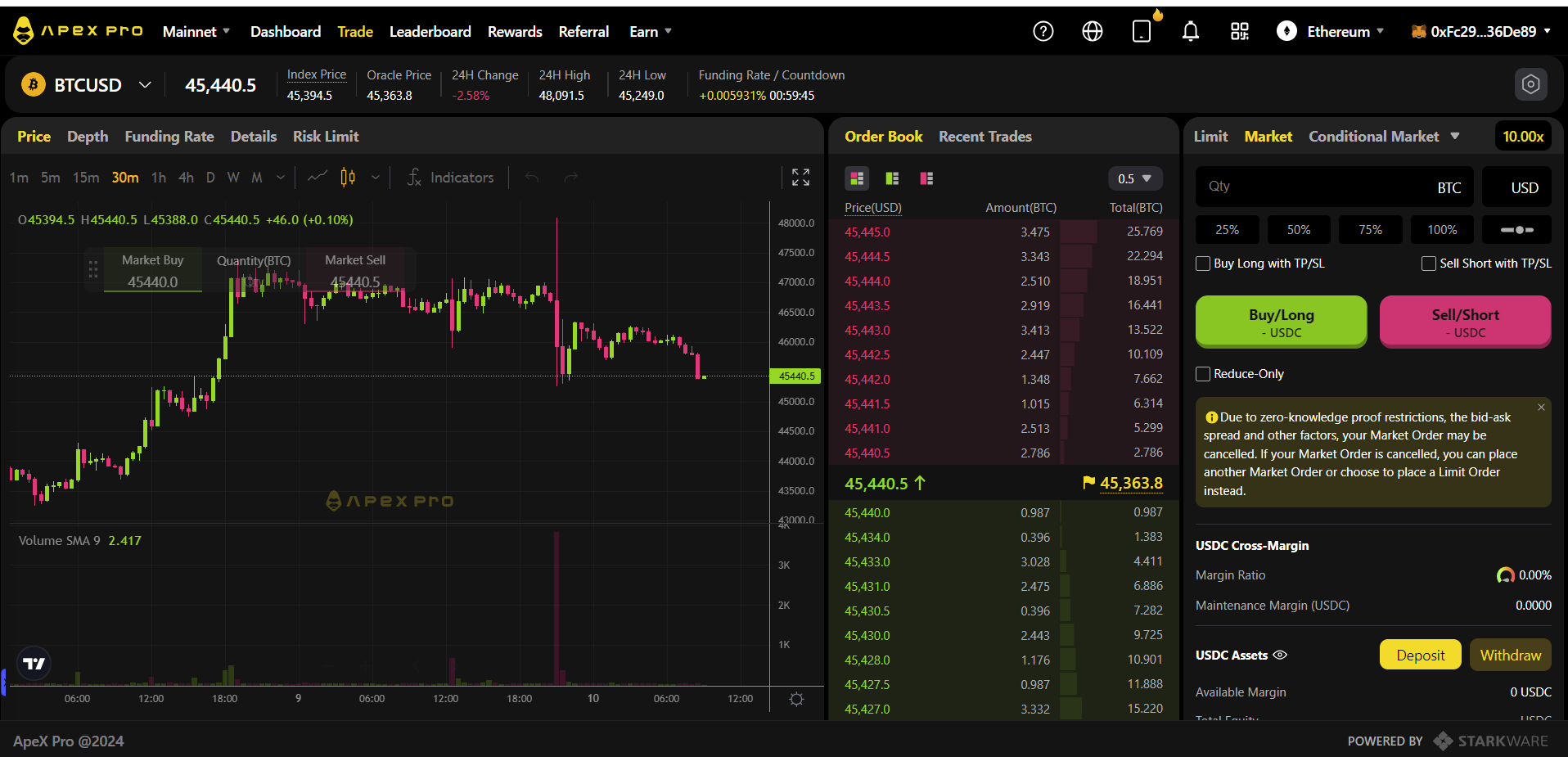

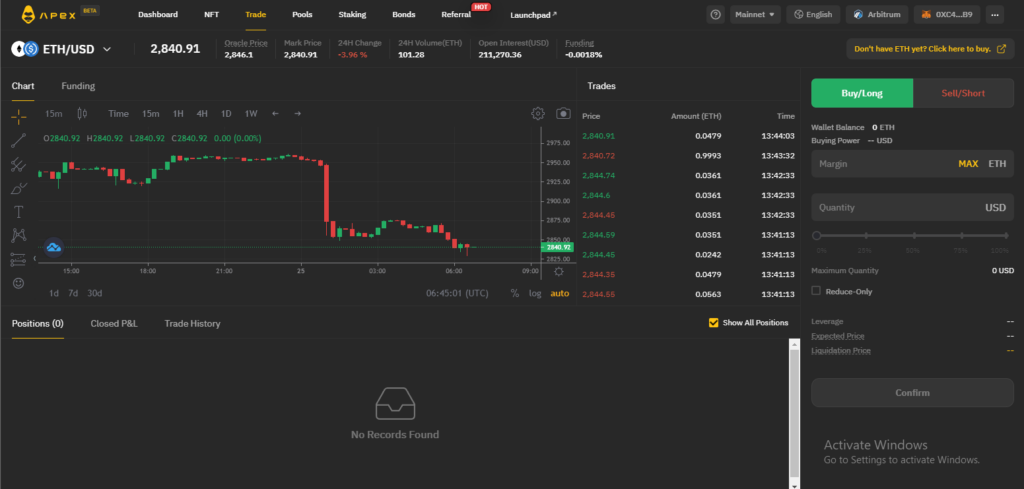

The ApeX Protocol initiative aims to establish a perpetual swap market for any token pair by means of a decentralized, non-custodial derivatives protocol.

Signup and login: Here

Among ApeX Protocol’s salient characteristics are:

- Leverage-based cryptocurrency perpetual contract trading is prohibited.

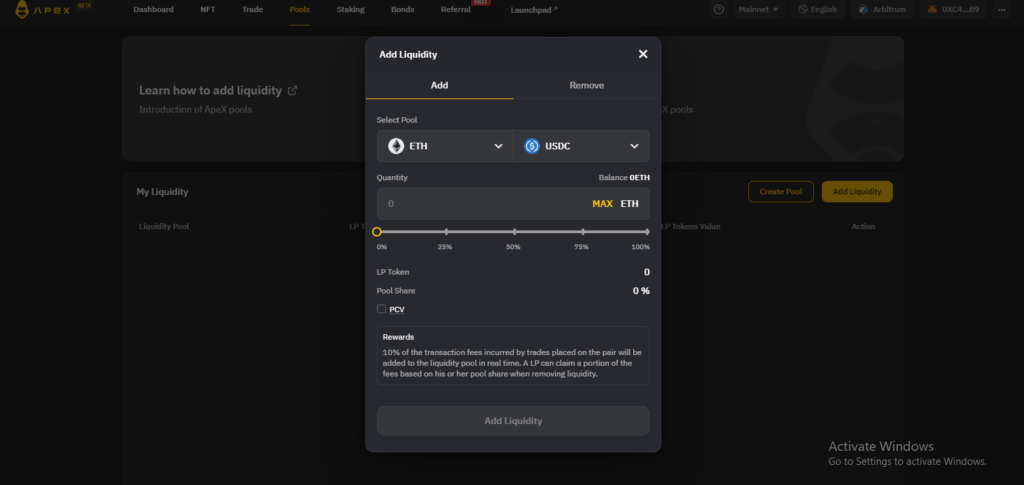

- Automated Market Maker that is elastic (eAMM).

- Value Controlled by Protocol (PCV).

By providing open and transparent financial tools, the ApeX Protocol project gives traders worldwide the ability to preserve and increase their assets. The ApeX Protocol seeks to increase accessibility to cryptocurrency derivatives trading and advance financial inclusion.

Unique characteristics of the ApeX Protocol initiative

Learn about eAMM – Elastic automated market maker (Elastic automated market maker)

The fundamental components of price discovery on ApeX Protocol are the immutable product formula (x * y = k) and the AMM model.

Elastic AMM (eAMM), a novel strategy employed by the ApeX Protocol Project, is based on algorithmic stablecoin protocols’ use of on-chain algorithms to maintain pegs. -chain seeks to alter supply in response to changes in the market.

By combining QUOTE assets into one BASE asset and enabling the offering of a single asset as a BASE asset, eAMM offers a spot-like trading experience while greatly increasing capital efficiency.

ApeX establishes a mathematical relationship between particular assets held in liquidity pools using the straightforward x * y = k equation. The eAMM pool consists of: One is BASE assets (such as BTC, ETH, LINK, etc.), and the other is dynamically provided QUOTE assets (such as USDC).

Fees on the ApeX Protocol:

There will be a 0.1% transaction fee applied to all transactions made on the ApeX Protocol. Specifically, the following is how transaction fees will be distributed:

- 10% of each BASE asset will be reallocated to eAMM.

- APEX (protocol native token) staking reward will receive thirty percent of the total.

- The DAO Treasury will receive the remaining 60%.

A “Liquidation Fee” derived from the residual value of the liquidated position will apply to trades that are liquidated on the ApeX Protocol. The allocation of the Liquidation Fee is as follows:

- 95% of the total will be transferred to eAMM’s corresponding BASE assets.

- The protocol liquidator receives the remaining 5%.

Information about the APEX token of the ApeX Protocol project

The $APEX token powers the ApeX Protocol and is mainly used for revenue sharing via ApeX Pro’s Staking Program, which distributes the trading fees generated on the platform to staking participants. It will also soon be used for community involvement over governance and protocol parameters.

Token APEX Key Metrics

- Ticker: APEX.

- Blockchain: Ethereum – Arbitrum

- Contract: Updating…

- Token Standard: ERC-20.

- Token Type: Utility, Governance.

- Circulating Supply: Updating….

- Total Supply: 1,000,000,000 APEX.

Token APEX Allocation

- 23% allocated to the core team and early investors with a 24-month cliff and a vesting period of 24 months

- 77% for participation rewards, ecosystem building and liquidity bootstrapping where it is 100% unlocked for TGE, but tokens allocated to the DAO will be locked for 36 months. $APEX utilized for trading or staking rewards will see 10% of the allocation unlocked at TGE with linear vesting over 48 months

- 25,000,000 $APEX have also been allocated to mint $BANA, ApeX Pro’s exclusive trading reward token distributed via its flagship program Trade-to-Earn, and locked over a minimum period of 12 months

- The vesting period lasts for up to a total of four years, which can incentivize long-term and continued involvement of all parties

Token APEX Release Schedule

- Team and early investors: Allocated to core team and initial investors with a period of 12 months starting from TGE, then linear vesting for 2 years.

- Strategic DAO Allocation: The remainder will be allocated to the DAO and the community. These include allocation for participation rewards, ecosystem building, and liquidity bootstrapping. Unlocked 100% at TGE. Tokens allocated to DAO will be locked for 36 months, trading rewards, staking, linking and other participation rewards are unlocked by 10% at TGE with vesting for 48 months.

Token APEX Use Case

APEX Token Holders can stake APEX Tokens on ApeX Protocol to earn lifetime trading fee discounts and other perks. By Staking Apex tokens, Token Holders can:

- Get reward APEX tokens

- Protocol transaction fees

- Participate in protocol governance

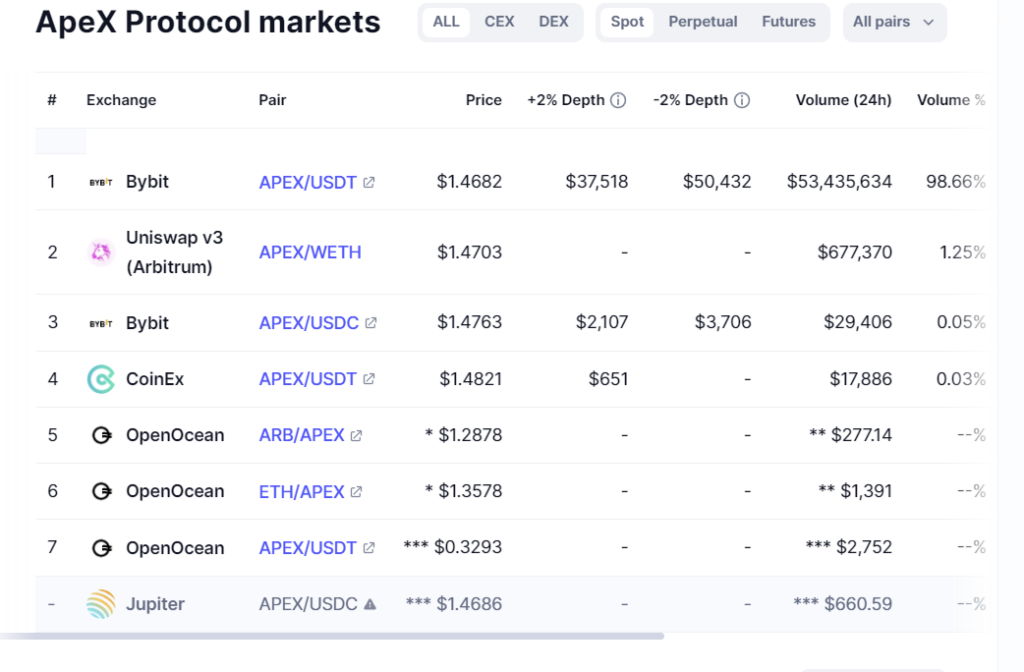

Where to buy, sell and own APEX tokens

APEX conducts IEO on Bybit Launchpad for 0.05$ in the form of BIT pledge to apply for token allocation or USDT pledge to win project allocation from lottery, Details you can see here.

After completion, APEX will be listed on Bybit and a few other exchanges

Roadmap of the ApeX Protocol project

Team of ApeX Protocol project

Updating….

Investors / Backers of the ApeX Protocol project

ApeX has raised seed funding from backers including Dragonfly Capital Partners, Jump Crypto, Tiger Global, Mirana Ventures, CyberX, Kronos and M77 Ventures.

An analysis of the ApeX Protocol project: is it wise to purchase APEX tokens?

The ApeX Protocol project is about a derivatives exchange platform (DEX) that has a lot of potential, much like DYDX and Pepertual Contract. Furthermore, despite the fact that the project does not reveal the primary development team, it is obvious from the interface and graphics that the team is most likely connected to Bybit floor. You must make your own investment decisions; the information above does not constitute investment advice.

This article is not intended to be investment advice; rather, it should be carefully considered before making any decisions involving your money. Any investment decisions you make are not attributed to Coin68. I hope you achieve great success and wealth.

Click to signup and trade with Apex Exchange now.