Without a trading journal, your prospects of being successful as a trader are quite slim.

Keeping a trading journal can assist you in monitoring your trading performance, including both wins and losses. It is regarded as an excellent instrument for delving deeper into the trading process and recording all that occurred, the state of the market, your plans, and your reactions to various emotions. How should these circumstances be handled, and what is the long-term fix?

Keeping a trading journal might also assist you in recognizing your errors. It’s also a place where you can generate fresh concepts to enhance your trading approach or technique. Easy enough, huh?

What is a forex trading journal?

Sometimes trading diaries don’t have to be long, pretentious writings; they can just be trading orders with the basic errors that are required in order to concentrate on improving for the following transaction.

It is sufficient to focus on the R:R ratio, trading mindset, system of trading techniques, and notes; there is no need to pay much attention to the trading diary.

We frequently make mistakes because we don’t follow the plan, wait impatiently for the right chance, and instead of looking for reasons why the order is failing, we should assess the method’s and our mentality’s efficacy and accept responsibility first. Accuse the source.

One of the best tools for traders to get better is the Trading Diary.

When you trade against your plan and don’t acquire any insight, don’t worry too much. Consider it your market tuition for the instances when you violated your trading principles.

Record every deal in your notebook, and review it at the end of the week to identify any errors.

Advantages of maintaining a trading journal

No two traders are the same. Every trader ought to keep a trading journal, but some—especially those who trade on diverse schedules—do not have the time to do so. little period of time.

Individuals who surf are unlikely to keep a trading journal because they frequently enter and leave orders during the day.

Actually, journaling while trading can occasionally be detrimental because it might cause you to become sidetracked and overlook opportunities or blunders.

You may still keep a diary, though, in an easy way without having to spend a lot of time or write it by hand.

It goes without saying that there are more advantages for traders to keep a trading journal than disadvantages.

There is no denying the advantages of maintaining a trading journal.

When keeping a trade journal, take note

There are certain essentials that you should always have in your trading journal, even though everyone keeps their trading journal in a different method. Here’s a list of things to emphasize in your journal to increase its utility:

- You should not trade in a time frame that is too small. Instead, take a screenshot and record the trading log, including the entry and departure points. This will provide you with a summary of the events that occurred throughout the trade.

- Mark the order entry point with a line or horizontal line to indicate whether the order was executed early or late and whether any opportunities were lost. Is that right, or are you typing orders too quickly?

- Keep track of any economic events that take place; this will enable you to observe how news affects the chart more clearly. Major economic websites frequently have coverage of economic happenings.

- Don’t forget to draw a few trend lines on the chart; they will help you clearly identify short- and long-term trends as well as significant support and resistance zones that you might have missed. You should also add a brief note about the trend and the overall state of the market that day.

- To determine how long your average order lasts, you need record the time you cease trading on the chart.

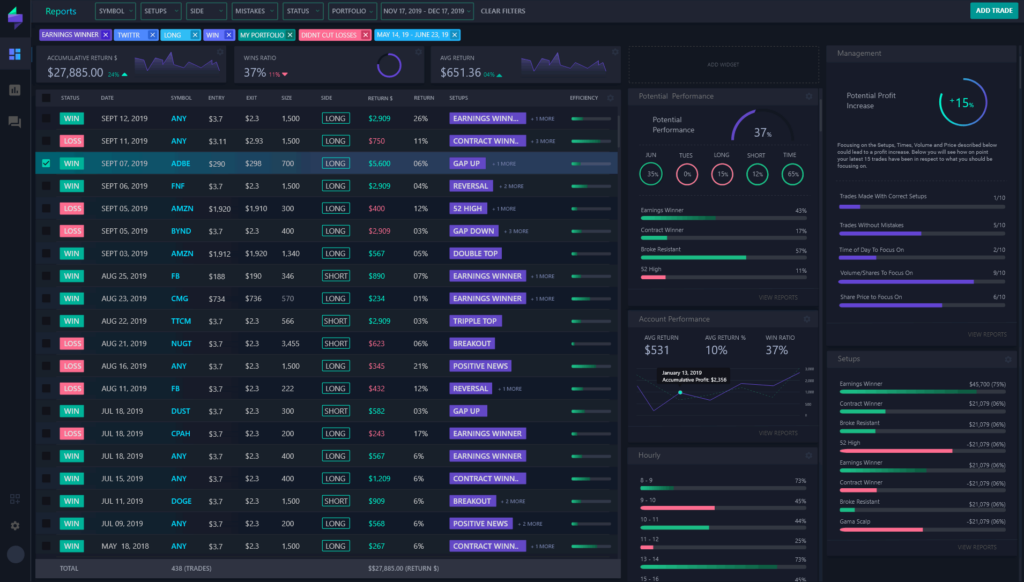

- Keep track of the total number of trades you have executed, the number of wins and losses, the total profit from each trade that you have won, the total shortfall in your budget from trades that you have lost, and the net profit or loss. What is the account’s loss percentage?

Even though trading mistakes are difficult, keeping a journal of your trades helps you learn from them.

- At the conclusion of each month, go over what you wrote in your diary, look for recurring issues, and assess your strengths and shortcomings. It is crucial that you use these findings to fully overcome errors and maximize your trading abilities.

- To have a market overview the next week, practice analysis every weekend.

No one can save you like yourself, so please put in a lot of effort to write a trading journal even if it can be extremely easy to develop a habit out of it.

Wishing you luck!